The method also doesn’t account for step costing — when the cost of a product changes after a customer buys a quantity of that product over a discrete volume point. For instance, if a customer buys a product from a business that has a step cost at 5,000 units, then every unit beyond those first 5,000 comes at a discounted price. The balance in the Allowance for Uncollectible Accounts Expense is @22,000 – $2,000 from the prior year’s sales that have not yet been determined uncollectible and $20,000 from 2019 sales.

Step 3 of 3

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

What you’ll learn:

Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide. This number may seem small, but it’s crucial when percentage of sales method you remember that she’s hoping for an increase of sales next month of $1,978. With a BDE of $1,100, she might be looking at merely an extra $878, which significantly impacts any new purchases she might be looking to make. The company then uses the results of this method to make adjustments for the future based on their financial outlook.

Estimate revenue growth for the upcoming time period

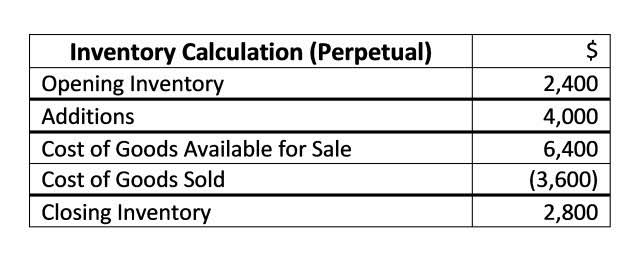

This is commonly done by percentage — if you know the percent amount your sales will increase, you can apply that to all line items as well, both assets and expenses. This includes things like accounts payable, accounts receivable, cash, cost of goods sold (COGS), fixed assets, and net income. The Percent of Sales Method is a straightforward and widely-used approach in financial forecasting and budgeting. This method helps businesses estimate future expenses, profits, and cash flows based on their projected sales. By expressing certain costs and expenses as a percentage of sales, companies can create more accurate and manageable financial plans. The percentage of sales method predicts future finances based on current revenue.

This technique is popular among advertising companies owing to its straightforwardness and the ability to directly link advertising expenditures with revenue or sales. The Percent-of-Sales method is a crucial tool in Marketing Mix Modeling, Sales Forecasting, Revenue Management, Profitability Analysis, and Pricing Strategy. It is a financial forecasting technique that utilizes historical figures to predict future sales within an organization. In this post, we will dive deeper into this https://www.bookstime.com/ method and answer the most commonly asked questions about it. A business would need to forecast the accounts receivable or credit sales using the available historical data. Understanding how quickly customers pay back credit sales over different periods, such as 30, 60, and 90 days, also helps.

Determine your estimated growth and most recent annual sales figures.

This article guides you through using the calculator effectively and provides insights into the formula, examples, and FAQs. Multiply https://x.com/BooksTimeInc the total accounts receivable by the historical uncollected accounts percentage to predict how much these bad debts might cost for the time period. Reviewing historical data of uncollectible accounts and the industry benchmark for bad debt expenses can work out the percentage needed for the forecast. Most business owners will want to forecast things like cash, accounts receivable, accounts payable and net income. Because the percentage-of-sales method works closely with data from sales items, it’s not the best forecasting method for things like fixed assets or expenses. An approach that estimates bad debts based on a percentage of credit sales, aligning expenses with related revenues.

Ask a Financial Professional Any Question

- Organizing the data before calculating can improve the process’s efficiency and accuracy.

- This method is often referred to as the income statement approach because the accountant attempts, as accurately as possible, to measure the expense account Uncollectible Accounts.

- Understanding and utilizing the Percent of Sales Method can help learners and professionals alike make informed and strategic business decisions.

- The balance in this account will always be a function of a predetermined percentage of credit sales when the net-sales method is used.

- This information about past sales data helps you predict future financial performance.

- This method is seen as more reliable because it breaks down the probability of BDE by the length of time past-due.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. At the end of any particular year, the credit balance in this account will fluctuate, but only by coincidence will it be equal to the debit balance in the account Uncollectible Accounts Expense. This assumes that all accounts determined to be uncollectible have already been written off against Accounts Receivable and the Allowance account.

However, the company’s net income is negative if that is not the case. The percentage of receivables method is similar to the percentage of credit sales method, except that it looks at percentages over smaller time frames rather than a flat rate of BDE. The percentage of sales method allows businesses to make accurate assessments of their previous sales so they can comfortably project into the future. The balance in this account will always be a function of a predetermined percentage of credit sales when the net-sales method is used. As we will see later the balance in the Allowance for Uncollectible Accounts is simply a result of the entry to record the estimated uncollectible accounts expense for the period. Marketing Mix Modeling involves analyzing how different elements of a marketing strategy impact sales revenue.