It’s ideal for high-volume management with advanced analytics and premium support. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication.

What is QuickBooks Enterprise great at?

QuickBooks Online is one of the company’s most popular accounting software choices for small-business owners. QuickBooks Online pricing is based on a monthly subscription model, and each plan includes a specific number of users. First-time QuickBooks Online users can typically receive a free 30-day trial or a discount for the first few months of service. Users can switch plans or cancel without having to pay termination fees.

QuickBooks Online Pricing And Plans (2024 Guide)

Standard accounting tools, including invoicing and payments, income and expense tracking, bill management and basic reporting. If you’re shopping for QuickBooks as a small-business accounting solution, first decide whether you’d like online, cloud-based quickbooks online vs quickbooks desktop software or a desktop product that locally stores your information. QuickBooks pricing varies quite a bit depending on which product you choose and how many users you need. QuickBooks Online Advanced costs $235/month and supports up to 25 users.

- Some of the other 20-plus built-in standard reports available include P&L by month and customer, quarterly P&L summaries, and general ledger.

- Simple Start runs basic reports, including cash flow statements, profit and loss (P&L) statements, and balance sheets.

- There is no need to download QuickBooks Online because it is connected to the cloud, which means you can access online accounting from any device with an internet connection.

- The best QuickBooks Online plan for you depends on the size of your business and your particular needs.

- Advanced users receive better customer support through its Priority Circle membership.

- Here’s a complete breakdown of what’s included with each QuickBooks Online pricing plan.

Yes, QuickBooks Online offers a mobile app that allows you to dine, shop share access your account, track expenses, create and send invoices, and more, all from your smartphone or tablet. We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. The main differences between the two QuickBooks plans are the ability to track inventory costs and calculate P&L by project. Other helpful features in Plus are budgets, classes, customer types, locations, and unlimited report-only users.

These prices rose in early 2024, when this plan cost just $30 per month. QuickBooks Money is a financial management tool for one-person businesses who need an all-in-one payments and banking solution. It’s free to open, with no monthly fees or minimum balance requirements, giving solopreneurs and freelancers control of their money from anywhere. If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $34 per month compared to Plus.

QuickBooks Online Pricing Plans

Businesses with inventory will likely get the most benefit from QuickBooks Plus. Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. FreshBooks’ pricing starts at $17 per month, so it costs a little less than QuickBooks’ $20-per-month plan. FreshBooks stands out for a great set of features, but it does not offer the payroll processing or advanced tools that QuickBooks has.

Tax Forms & Support

Retailers and wholesalers should choose Plus so that they can track the quantity on hand and the cost of inventory. Contractors should also select Plus to track the profitability of individual projects. Other businesses should consider whether tracking P&L by class and location is worth the extra $34 per month. For operations paying their employees through checks, QuickBooks Online Essentials fits the bill. It is also suitable for those doing business outside the US, as it supports multiple currencies, unlike Simple Start. Essentials even lets you record employees’ worked hours and track billable hours by customer and project.

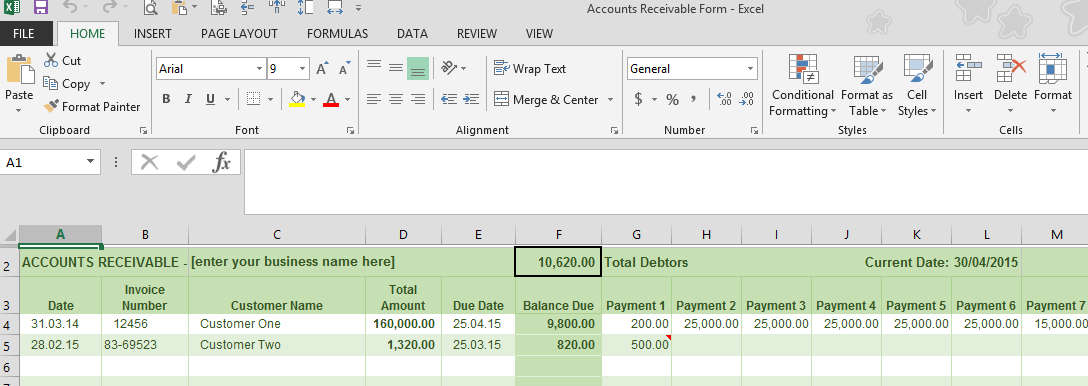

Your business size and structure will determine which QuickBooks Online plan is best. If you’re a single freelancer, you won’t need to manage any other employees, and you won’t need to track many sales (if any) – so the Self-Employed Plan is best for you. We’ve ranked the best self-employed accounting software, and QuickBooks is at the top. Setting up what is an accounts receivable ledger the software involves plenty of one-time tasks that you’ll want to get right the first time, like connecting your bank account and setting up a series of automated processes and templates. Through Live Bookkeeping, you’ll get a single one-on-one session that can clear up any questions and start your accounting software subscription off on the right foot. You can create an unlimited number of invoices and estimates, track your expenses and manage up to 1,099 contractors.

Some of Xero’s plans cost less than QuickBooks’ plans, but most do not. Xero’s plans cost $13, $37, and $70 per month, compared to the QuickBooks $17.50, $32.50, and $49.50 per month plans. However, the “Secure” brand of checks offer in-depth fraud protection measures that may justify the price, provided you anticipate security risks at your business. Also available from the service is a lending program called QuickBooks Capital. Those with QuickBooks Online accounts are potentially eligible, though they’ll still need to qualify on the strength of their accounting history.

Meanwhile, Simple Start is a good starting point for most small businesses, especially those that don’t need to enter bills, track billable hours, and manage projects and inventory. It includes payroll processing, which allows you to calculate and track payroll taxes, and it lets you track assets and liabilities and use automated sales tax on invoices. Additionally, it enables you to record and track payments made to 1099 contractors. Although it has the lowest starting price, at $12 per month, it can be a little more difficult to navigate than QuickBooks or FreshBooks. Because there is an unlimited number of users that can use the program, you can maximize its use if you have a team of professionals who need access to your accounting software.